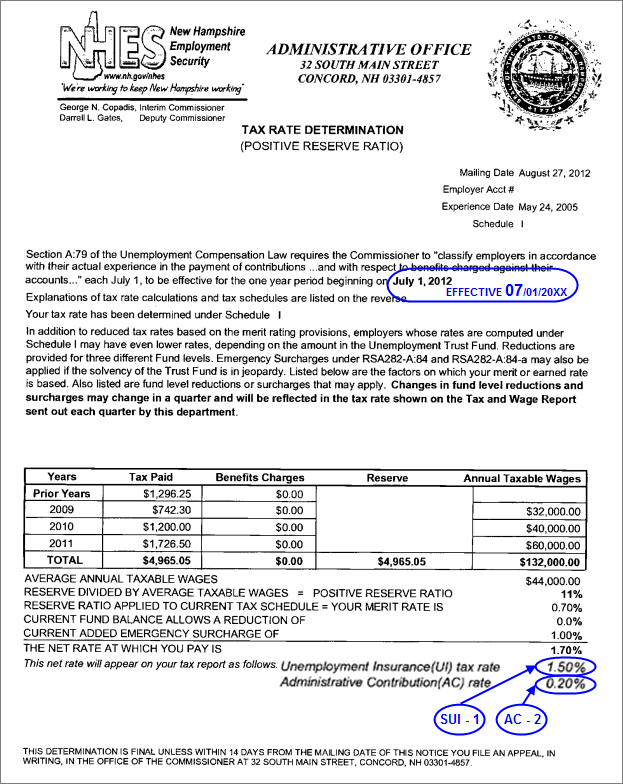

New Employer Sui Rates By State 2025 - Unemployment Rate By State, In general, employers pay suta taxes, but three states have an exception. Here they are, along with their employee tax rates: QuickBooks Online How to update Employer Tax rates for ETT and SUI 2023, What are employer unemployment insurance contribution rates? .0010 (.10%) or $7.00 per.

Unemployment Rate By State, In general, employers pay suta taxes, but three states have an exception. Here they are, along with their employee tax rates:

Alaska’s Unemployment Insurance Taxes, Ranked Alaska Policy Forum, On may 1, 2023, colorado governor jared polis signed into law s.b. State unemployment insurance taxable wage bases for 2025.

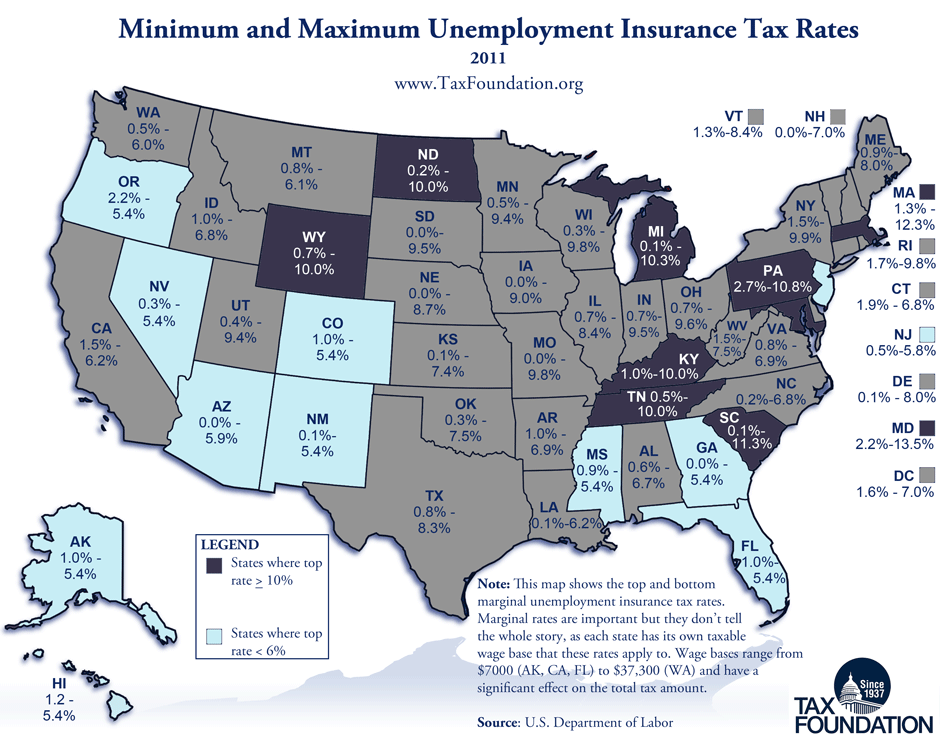

Here's every state's unemployment rate, The rate for a foreign contractor (new construction employers headquartered in another state) is. Your suta rate for 2025 is like a recipe made up of two main ingredients:

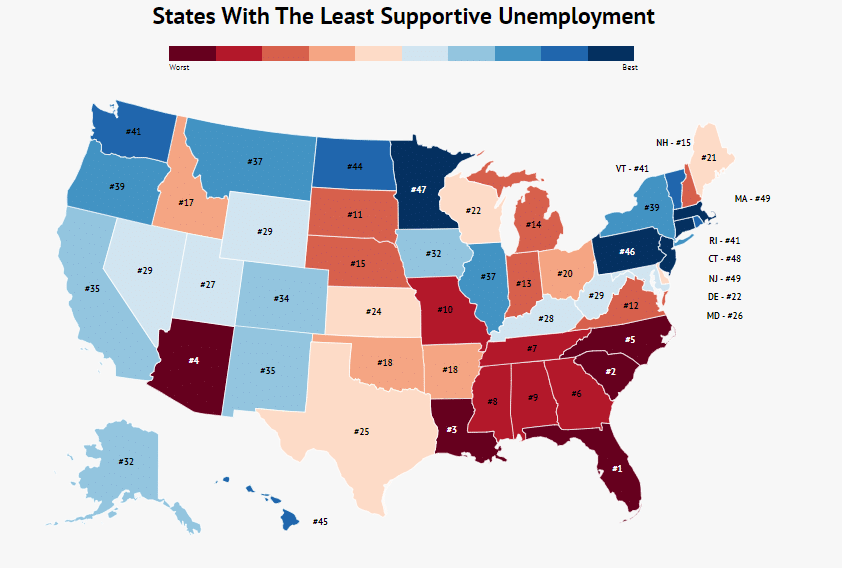

New Employer Sui Rates By State 2025. The latest report showed the state with the lowest unemployment was north dakota, with a jobless rate of 2.0%. For example, states like new york and the district of columbia have.

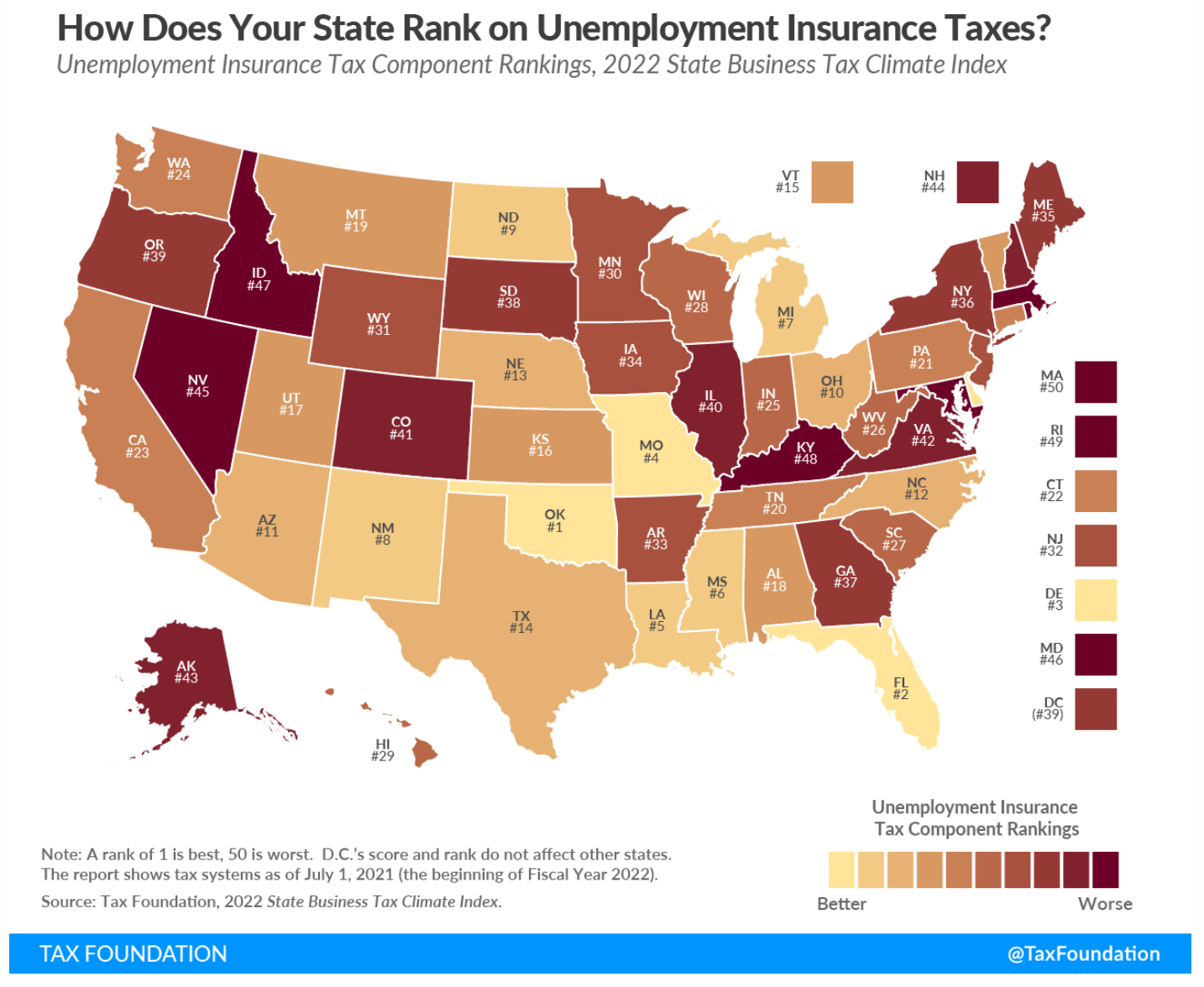

2025 state unemployment wage base limits and rates.

Following is the final list of the 2025 sui taxable wage bases as of january 16, 2025 (as compared to 2023) and employee sui withholding rates, if applicable. For example, states like new york and the district of columbia have.

State Unemployment Insurance (SUI) overview, For 2025, the range of new york state unemployment insurance ui contribution. State experience factor & employers' ui contribution rates:

What Is My State Unemployment Tax Charge? FinancialServicesLife, The minimum and maximum tax rates for wages paid in 2025 are as follows (based on annual wages up to $7,000 per employee): View table a tax rate schedule.

232, making numerous changes to the state's unemployment insurance (sui) law.

Irs 2025 Income Tax Brackets Head Of Household. 10%, 12%, 22%, 24%, 32%, 35%, and […]

In general, employers pay suta taxes, but three states have an exception.